The Ultimate Guide to Auto Refinance: Save Money on Your Car Loan

Auto refinancing is a great way to save money on your car loan and improve your financial situation. By refinancing, you can lower your monthly car payments and pay off your loan faster. This guide will help you understand everything you need to know about auto refinancing, including the process, the benefits, and how to get started.

What is Auto Refinance?

Auto refinancing is the process of paying off your existing car loan with a new one, usually with a lower interest rate. This can reduce your monthly payments and help you save money on interest over the life of the loan. Refinancing can be done with your current lender or with a new lender.

Benefits of Auto Refinance

There are many benefits to auto refinancing, including:

- Lower monthly payments: By refinancing with a lower interest rate, you can lower your monthly car payments and have more money available for other expenses.

- Shorter loan term: Refinancing can also allow you to shorten the length of your loan and pay off your car faster.

- Improved credit score: Making timely payments on a refinanced car loan can also help improve your credit score.

- Money saved on interest: By reducing the interest rate on your loan, you can save money over the life of the loan.

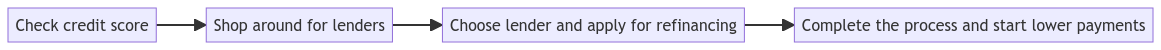

How to Refinance Your Auto Loan

Refinancing your auto loan is a straightforward process. Here are the steps to follow:

-

Check your credit score: Before you refinance, it’s important to check your credit score to see if you’re eligible. You can get a free credit score from a variety of online sources.

-

Shop around: It’s important to compare rates and terms from multiple lenders to find the best deal for you.

-

Choose a lender: Once you’ve found the right lender, you can apply for a refinancing loan.

-

Complete the process: After you’ve been approved, the lender will pay off your existing loan and provide you with a new loan.

How to Find the Best Auto Refinance Rates

To find the best auto refinance rates, you should:

-

Check your credit score: Your credit score will play a big role in determining the interest rate you qualify for.

-

Compare rates: Get quotes from multiple lenders to compare rates and find the best deal.

-

Consider the loan term: Short-term loans typically have lower interest rates, but also higher monthly payments. Long-term loans have lower monthly payments, but also higher interest rates.

-

Negotiate: Don’t be afraid to negotiate with lenders to get the best rate.

The Bottom Line

Auto refinancing is a great way to save money on your car loan and improve your financial situation. By lowering your monthly payments and paying off your loan faster, you can free up money for other expenses and improve your credit score. Follow these steps to get started with auto refinancing today.

Trusted Across the Nation

OpenRoad is a member of the American Financial Services Association, A+ accredited by the BBB, an Inc. 500 fastest growing business and a Dallas Business Journal Best Places To Work Company.

Low Rates and Amazing Savings

OpenRoad has refinanced tens of thousands of auto loans and to our customer’s delight saved an average of more than $100 a month†. That’s over $1200 a year.

Happy Customers

With Financing solutions for all credit types, for years OpenRoad has set itself apart by providing World Class Customer Service. We are proud to have a 98% customer satisfaction rating.

Quick, Easy, and Secure

Apply online or over the phone from the comfort and privacy of your own home with no cost or obligation. Quick loan decisions, flexible financing options and cutting edge technology for a great experience!

Quick & Easy

Upload and sign your documents from your phone, a laptop or any tablet. Saving money on your auto loan has never been easier.

No Car Payments for 90 Days

Once your approved for your auto refinancing you’ll enjoy up to 90 days with no payments on your vehicle.

Customize Your Loan

Lower your monthly car payment. Extend the term of your auto loan or remove a co-signer. Our knowledgeable loan officers are here to guide you. They can also help you bundle auto protection plans into your loan such as Vehicle Service Contracts (VSC), GAP insurance and Depreciation Protection. It’s time to Grab Life By The Payments.

Sign Loan Documents Anywhere

We make it simple for you to refinance your car from anywhere. This makes the process of refinancing simple and fast. Upload and sign your documents from your phone, a laptop or any tablet. Saving money on your auto loan has never been easier.