You’ve received a car refinance offer letter in the mail about refinancing your car loan. Awesome I can save a bunch of money. Here is what you should do next and what information about your vehicle and car loan will be needed.

Depending on your comfort level interacting with people you have options to get the best deal and a new auto loan. Many companies now have pure online processes to get all the information necessary. A bit quicker is to just call them and get the ball rolling to find the best deal. If you currently bank with a Credit Union you might want to contact them and explain you received a letter about refinancing your car to see if they will offer you a direct deal.

The company that sent you the car refinance offer letter typically gets that information from semi-public sources like the credit reporting agencies. They either directly request information about consumers who fit a credit profile or they buy the info along with a mailing service to send you the letter. It’s an effective way to advertise and target the right people who might qualify to lower their interest rate or montly payment.

Once you get in touch with the company who is offering you a car refinance deal they will require some more information.

- They will verify your personal information

- Update contact information they have on file

- Request your Social Security Number & Birthday

After they know they are speaking with the right person you will need to share some details about your car.

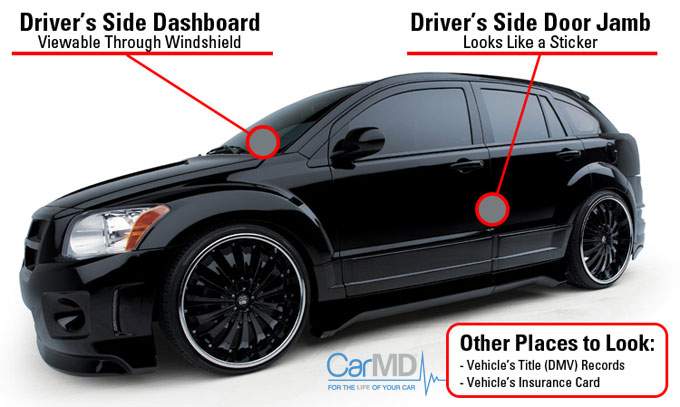

- Find your VIN (Vehicle Identification Number) – this can usually be found on your drivers side by looking down into the front window. It is also on the door and it’s actually stamped into other pieces of your car. You might also find it on your Proof of Insurance -Image from: CarMD

- You will need to write down the current mileage and take a picture of it so you have that ready if they request verification

The next and final information they may want is employment. Do you work? Where? How much do you make? Etc. In some cases they don’t require this if your credit score is high enough.

With all of this info ready you can make the initial call with a loan representative at most of the car refinance companies go smoothly and quickly. You’ll be on your way to saving money.

A couple other things to be aware of if you have received a car refinance offer letter:

- The lender will need to do a “Hard Credit Check” and this will effect your credit score. Learn more about Credit Checks

- If you only have Fair Credit you might want to wait until you can improve that so you can get a better deal. Learn more about Raising Your Credit Score

- And if you are a Gig Economy Worker or Side-Hustler then you might need Tax Returns, 1099s, or other verification documents, sometimes Bank Statements work. Find out How to Structure Your Side Hustles